Rhb Fixed Deposit Rate 2020

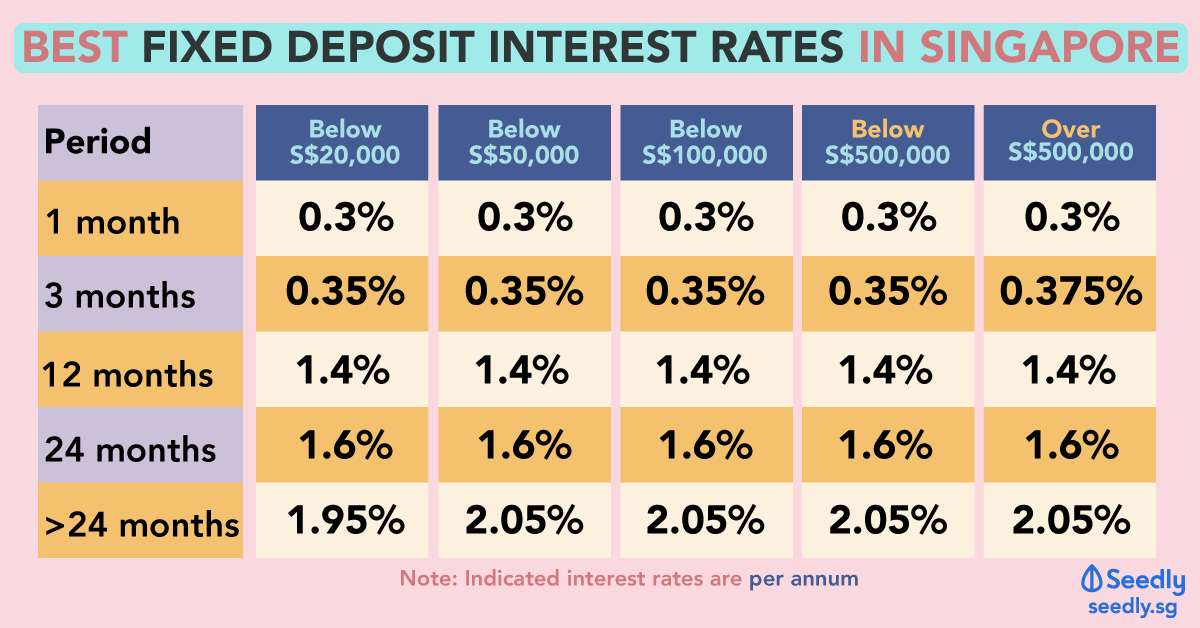

RHB fixed deposit board rates. Choose from a deposit tenure of 3 months to a maximum of 36 months, with a minimum placement of S$1,000. (4 days ago) There is currently no fixed deposit promotional rate for RHB Fixed Deposits. The current highest fixed deposit rate is a RHB board rate The current Money Lobang National Average Fixed Deposit Rates for February 2021 is 0.47% p.a. The average monthly highest fixed deposit rate for RHB since 2018 is 1.08% p.a. In a separate statement, RHB Banking Group said it will be revising its BR and BLR downwards by 25 basis points, to 3.25% and 6.2% respectively, effective March 9. The bank’s fixed deposit rates. Malaysia Fixed Deposit Rates 2020. Bank Fixed Deposit Rates (FD rates) is quite important to some of the investors. No doubt, our parents are one of those hard core fans of it. Let’s have a look on Malaysia Bank fixed deposit rates in year 2020. Interest rates on fixed deposits have been revised by Canara Bank effective 8 February 2021 for deposits below Rs.2 crore. Interest rates have been reduced on fixed deposits maturing in one year by 5 basis points so that the interest rate is now 5.20% p.a. Interest rates on tenures ranging from 2 years to 10 years have been increased.

Public Bank says it remains committed to providing necessary financial assistance to its customers, particularly during this current period of the unprecedented Covid-19 outbreak.

KUCHING: Both CIMB Bank Bhd (CIMB Bank) and Public Bank Bhd (Public Bank) are adjusting their rates in response to Bank Negara Malaysia’s (BNM) Overnight Policy Rate (OPR) reduction of 50 basis points to two per cent.

CIMB Bank and CIMB Islamic Bank Bhd (CIMB Islamic) will effect a corresponding 50-basis point reduction in their base rate and fixed deposit/fixed return income account-i board rates.

Similarly, all financing facilities based on base lending rate (BLR) and base financing rate (BFR) will be reduced by 0.50 per cent.

“This third OPR cut for 2020 is essential to bolster the Malaysian economy amid the subdued domestic and global economies coupled with plunging oil prices,” CIMB Group said in its statement.

“This step, together with the government’s economic stimulus package, will lower the cost of borrowings and boost spending power for individuals and businesses to eventually help spur the domestic seconomy.

“In doing our part, CIMB aims to help customers and communities tackle cash flow issues by providing various financial programmes, in line with government policies, during this most crucial period.”

In a separate statement, Tan Sri Tay Ah Lek, managing director and chief executive Officer of Public Bank said it will reduce its base rates and BLR/BFR by 0.50 per cent effective May 12, 2020.

At the same time, Public Bank’s fixed deposit rates will also be correspondingly adjusted by 0.50 per cent, effective on the same date.

“The year to date cumulative reduction in base rate of 100bps will assist in easing the borrowers’ burden and this is especially significant under the current challenging period brought about by the Covid-19 outbreak and the enforcement of the Movement Control Order necessary to stem the outbreak,” he said.

“This, coupled with the government’s fiscal stimulus and BNM’s financial relief measures, will lend support to the economy enabling the gradual recovery in the economic activities.

“Public Bank is always committed to providing necessary financial assistance to its customers, particularly during this current period of the unprecedented Covid-19 outbreak.”

RHB Banking Group also revised its Base Rate and Base Lending Rate (BLR) downwards by 50 basis points effective May 13, 2020.

In a statement, the RHB Banking group said RHB Bank Bhd (RHB Bank), RHB Islamic Bank Bhd and RHB Investment Bank Bhd will reduce its BR from 3.25 per cent to 2.75 per cent per annum, and will also revise the BLR from 6.20 per cent to 5.70 per cent per annum.

Rhb Fixed Deposit Rate July 2020

RHB Banks’ fixed deposit rates will also be revised downwards by 50 basis points effective May 13, 2020.