Amex Cd Rates

Disclaimer: This post contains references to products from one or more of our advertisers. We may receive compensation (at no cost to you) when you click on links to those products. Read our Disclaimer Policy for more information.

What percentage am I charged if I withdraw money before the maturity date? For CDs less than 12 months, the fee is 90 days of interest. For terms from 12 months to less than 48 months, the fee is 270 days of interest. Terms from 48 months to less than 60 months, the fee is 365 days of interest. Here are the Best CD Interest Rates for February 2021. 5 year: Navy Federal Credit Union, APY: 1.01%, $1,000 Min. Deposit; 5 year: Suncoast Credit Union, APY: 0.95%, $500 Min. The Amex savings rate of 0.85 percent with better than 2 year CD rates and only 5 basis points lower than both Amex's 36 month CD rate and 48 month CD rate. Amex Bank also offers a CD calculator you can use to help you figure out how much interest you will earn on your CD deposit. American Express offers world-class Charge and Credit Cards, Gift Cards, Rewards, Travel, Personal Savings, Business Services, Insurance and more.

These days, it can be tough to find a simple, affordable bank that allows you to store your hard-earned cash without extra fees or trying to upsell you with other banking products.

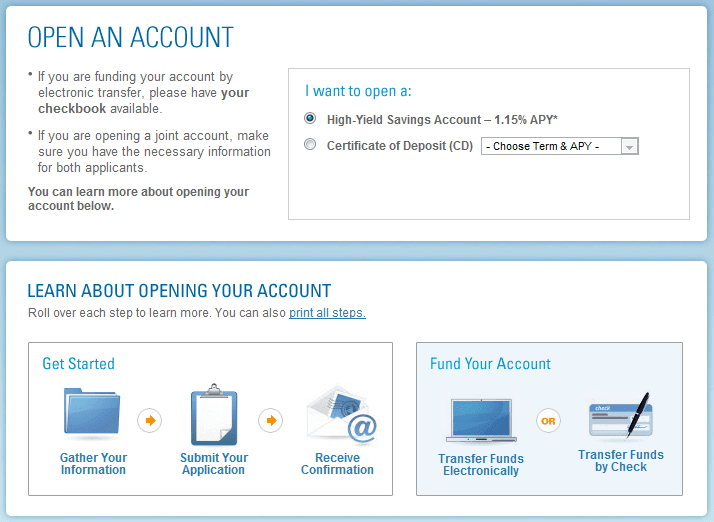

AMEX is different – it’s an online-only savings institution that allows you to save your money in either a basic high yield savings account or in a CD savings account.

Let’s break down everything you need to know about this accessible and affordable bank now.

Although rates have decreased steadily since the Federal Reserve's March 2020 rate cuts, the rates featured on this page are still strong compared to the national average of 0.14% APY for one-year.

American Express Bank Overview

What is American Express Bank?

American Express Bank or AMEX is an online-only bank that offers various specialized or personalized banking products to help you save and reach your financial goals.

It’s a good choice for saving money but does not include options for other account types or loans.

What Does American Express National Bank Offer?

There are tons of online banks to choose from, but AMEX is distinguished in large part due to its high-quality savings accounts and good CDs or certificates of deposit (which is a type of savings account).

These specialized savings accounts are perfect if you want to save money until the maturity date to prevent anyone from dipping into it, such as a college savings account.

While it has a variety of online offerings, AMEX does not have any in-person branches. Therefore, your banking experience will be entirely digital; whether or not this is a downside depends on your preferences.

Its overall banking options are also quite limited, making this a good pick for folks who specifically need to save money.

AMEX Bank Featured Products

Amex Personal Savings (High Yield Savings Account)

- Account Minimum: $0

- APY: 0.50%

AMEX’s online savings account has one of the best annual percentage yields in the industry and is incredibly accessible since it requires no account minimum and has no monthly service fees.

Of course, it doesn’t come with an ATM card, given AMEX’s online-only status. All in all, it’s an ideal savings account for students, singles, and individuals needing a no-nonsense and affordable banking option to stash their cash.

American Express CD Rates

If you’d rather store your money until a particular date, such as saving for college or saving up to make a big purchase, you can transition your savings account into a certificate of deposit.

These have maturity rates ranging from 6 to 60 months, and each account comes with competitive interest rates.

You can’t contribute extra money to a CD as you can with a savings account, but these are undoubtedly great options if you have lump sums you want to grow over a period of several years.

You’ll end up with more than if you’d used a regular savings account because of the included high-interest rates.

Related: Best CD Rates

Additional Financial Products Offered by AMEX

- Credit Cards: AMEX offers a variety of credit cards. These have a range of credit limits and varying credit score requirements, so you don’t need perfect credit to get a card from here. You’ve probably heard of several of these credit cards already, including the American Express Gold Card and American Express Green Card

- Personal Loans: Unfortunately, AMEX doesn’t offer personal or business loans in any capacity. Therefore, you’ll need to visit a different financial institution to access these banking products.

- Business Loans: See above.

American Express Bank Review: Fees, Customer Support, & Experience

Banking Experience

AMEX’s bank website is pretty navigable and intuitive (which is important since it doesn’t have any brick-and-mortar branches).

It also has a high-quality FAQ section you can peruse if you have any basic questions you need answered quickly.

Customer Support

AMEX’s customer service is hit or miss overall. While you can call them 24/7, the mobile app is only available for AMEX’s credit cardholders.

Furthermore, you may not be able to reach someone online at all hours of the day.

Overdraft Fees

AMEX’s overdraft fees are about middle-of-the-road compared to other banking institutions. You’ll pay on average $34 for every overdraft charge on your credit card.

AMEX Bank Pros and Cons

Pros:

- AMEX’s online website is easy to use and understand.

- AMEX offers an excellent personal savings account option with a good APY.

- AMEX’s CDs have good interest rates and a decent range of term lengths to suit any savings goal.

- There are no hidden or strange fees to worry about.

- It’s easy to open an account since there’s no charge and no minimum account balance.

Cons:

- No in-person branches, so everything must be handled online (i.e. you need a computer to bank with this company).

- No loans, either, so it’s really only a good choice for saving your money.

American Express National Bank FAQs

Is American Express a Good Bank?

Amex Cd Rates

That depends on what you need out of it. AMEX is a perfect pick if you need a simple bank in which to store your paychecks or save up for a big purchase, like a car loan or a down payment on a house.

But it’s very limited in other ways. You’ll need to take care of most of your other banking goals elsewhere, including getting loans or opening a checking account.

Is American Express National Bank FDIC Insured?

Yes. All of your deposits are insured as long as they don’t exceed $250,000.

Is American Express National Bank a Real Bank?

American Express National Bank Cd Rates

Yes. It saves your money and can provide you with credit cards. But it doesn’t have any brick-and-mortar bank locations you can visit.

Is American Express Online Banking Safe?

Yes. AMEX’s online website is protected with SSL certification and other digital security measures.

Bottom Line: American Express Bank Review

All in all, AMEX does a great job at what it sets out to do: provide affordable and accessible savings options for regular folks. So long as you come to this bank needing an easy savings account option, you’ll likely be satisfied.

Keep Reading:

© baranq/Shutterstock A man looks at a computer.American Express Bank gives its customers several options for choosing a certificate of deposit (CD) with terms from six months up to five years. The bank doesn't require a minimum deposit to open a CD, giving you the opportunity to choose exactly how much you put into your account. Interest compounds daily, allowing you to efficiently watch your money grow over time.

American Express gives you the option to either withdraw interest payments penalty-free or keep your profits in the account to continue earning interest. Withdrawing interest payments will, however, cause your APY to be lower since your starting rate assumes you will keep your interest payments in the account until the maturity date.

While other banks offer higher CD interest rates, American Express CDs still make our list of the best CDs for offering no minimum deposit and accessible customer service. Bankrate gives American Express Bank four stars out of five in its overall bank rating.

American Express CD Rates

An Amex CD is a straightforward way to lock in a fixed interest rate for your savings. Let's take a closer look at what American Express Bank offers.

| Account name | Term | APY | Minimum deposit |

| CD | 6 months | 0.10% | $0 |

| CD | 12 months | 0.20% | $0 |

| CD | 18 months | 0.30% | $0 |

| CD | 24 months | 0.40% | $0 |

| CD | 36 months | 0.45% | $0 |

| CD | 48 months | 0.50% | $0 |

| CD | 60 months | 0.55% | $0 |

Video: 10 Places Where Social Security Offers the Best Standard of Living (Money Talks News)

Note: The APY (annual percentage yield) shown is as of Jan. 4, 2021. The APY may vary in region.

How American Express compares to top-yielding banks

Amex CD rates are far below those of other banks with top-earning CDs - especially for accounts with terms less than three years. Marcus by Goldman Sachs, for example, offers a much higher rate on its 12-month CD.

American Express does offer accounts with no minimum deposit, while Marcus requires at least $500 to open an account. But Ally Bank, among others, also offers no minimum deposit with much higher interest rates. Other CD terms tell the same story - American Express CD rates don't reach those of the best certificates of deposit.

Other savings options at American Express

American Express Bank offers more than just certificates of deposit to hold your savings. If you want more flexibility for adding and withdrawing funds, the American Express high-yield savings account with no fees and no minimum account balance. Amex allows up to nine withdrawals from high yield savings each statement cycle.

Amex Cd Rates Today

Because American Express doesn't offer a checking account or issue debit cards or checks for its high-yield savings account, you'll have to transfer funds to another bank to make a withdrawal. The bank is completely online, so you won't be able to visit a physical branch. You can, however, reach American Express customer support 24 hours a day.

American Express Savings Rates

Featured image by baranq of Shutterstock.