Td Mobile Deposit

The TD Bank mobile check deposit limit for customers with accounts opened for 3 to 6 months is $1,000 per day and $2,500 per rolling 30-day period; for customers with accounts opened for 6 to 12.

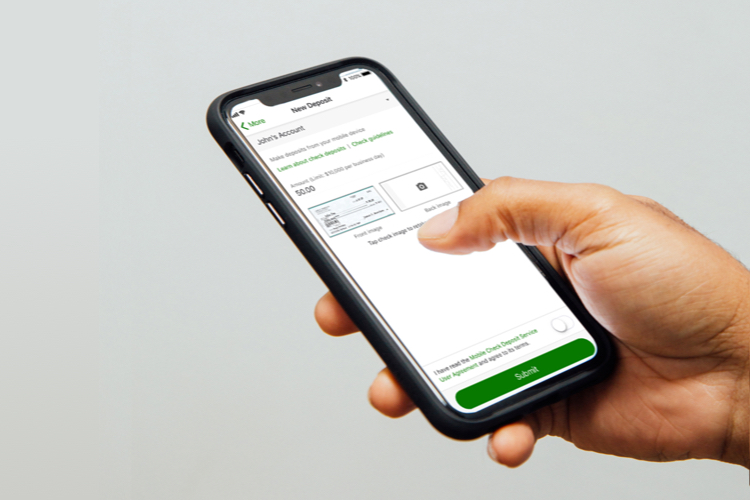

- TD Bank Mobile Banking App. Have a TD Bank checking or savings account? Download the mobile banking app to access your accounts from your smartphone or tablet. Visit your app store to download the app 1. Learn more about personal mobile banking. Learn more about small business mobile banking.

- As a TD Bank business customer, you can have your own remote deposit capture right at your office. Instead of bringing checks to the bank, just scan them and the image of the check is captured and immediately transmitted to TD Bank. As with all check deposits at TD Bank, your funds are available the next business day.

Click to see full answer.

Hereof, how long does TD Bank Online Deposit take?

Td Bank Online App For Windows 10

When you deposit a check before 8:00 p.m. ET on a business day, the date of deposit is the same day. In most cases, funds are available the business day following your date of deposit. (For example, if you make a deposit at noon on Monday, the funds will be available on Tuesday.)

Furthermore, why is there a hold on my deposit? The most common reason banks put a hold on funds in your account is to ensure that a check clears. Putting it simply, they want to make sure they receive the appropriate funds before these funds are made available to you. However, with larger checks, that might not always be the case.

Beside this, why is there a hold on my check deposit TD Bank?

If the issuing party doesn't have sufficient funds in his or her account, or if the cheque is fraudulent, the item can be returned unpaid to TD. A hold period allows sufficient time for TD to verify that the promise to pay can be carried out, i.e. that funds will be available.

What time of day does TD Bank post deposits?

Td Mobile Deposit Funds Pending

As long as you transmit your payroll 2 banking days prior to the paycheck date, direct deposits are made available to the receiving bank as of 5 pm PT on the paycheck date. However, if the paycheck date falls on a non-banking day, direct deposit paychecks will be posted on the next banking day.

We matched that to:

Td Mobile Deposit Limit

Is there a limit to the amount I can deposit using TD Mobile Deposit?

Td Mobile Deposit Cut Off Time

Yes, there are limits on the amount of funds you can deposit on a daily and rolling 30-day basis. Your Mobile Deposit cheque(s) Daily Limit and your 30-Day Limit will be displayed under the Amount field in the Deposit Cheque screen.

Please note that the answers to the questions are for information purposes only for the products discussed. Individual circumstances may vary. In case of discrepancy, the documentation prevails.