Structured Deposit

SharkFin Structured Deposit is a structured deposit with payoff linked to the performance of the underlying currency pair, the USDSGD Spot FX rate. Fixed Interest of 0.40% absolute (0.76% p.a.) will be paid at maturity. Bonus Interest will be paid out at maturity, if ‘Underlying. Structured investments involve a variety of risks. Structured investments may be linked to a wide variety of underlying assets, and each underlying asset will have its own unique set of risks and considerations. For example, some underlying assets have significantly higher volatility than others. Structured Deposit Products. Structured deposits are savings accounts where the return is based on the performance of an index. Normally if the index is higher than it’s starting level on the maturity date you will receive an interest payment. If the index has dropped or stayed the same you would not receive any interest. Structured deposits. Structured deposit plans are deposit-based and will usually be fully protected from stock market risk at the end date and also benefit from the protection of the Financial Services Compensation Scheme, if the bank or building society is a licensed UK deposit taker.

While searching for Chinese New Year fixed deposit promotions, I came across the above promotion advertised. The bank is offering structured deposit that offers up to 12.1% returns over 6 years. It sounds very attractive to me given the high interest rate.

Unlike traditional deposits, Structured Deposits have an investment element and returns may vary. The initial investment amount of a Structured Deposit will be returned to you only if you hold it until maturity date. Early withdrawal of Structured Deposits may result in you receiving significantly less than your initial investment amount.

Structured Deposit Research

As I am not familiar with structured deposit, I decided to do some further research on it.

What is a structured deposit?

A structured deposit is actually a deposit that is combined with an investment product. The returns on the structured deposit will depend on the performance of the underlying financial asset, product or benchmark.

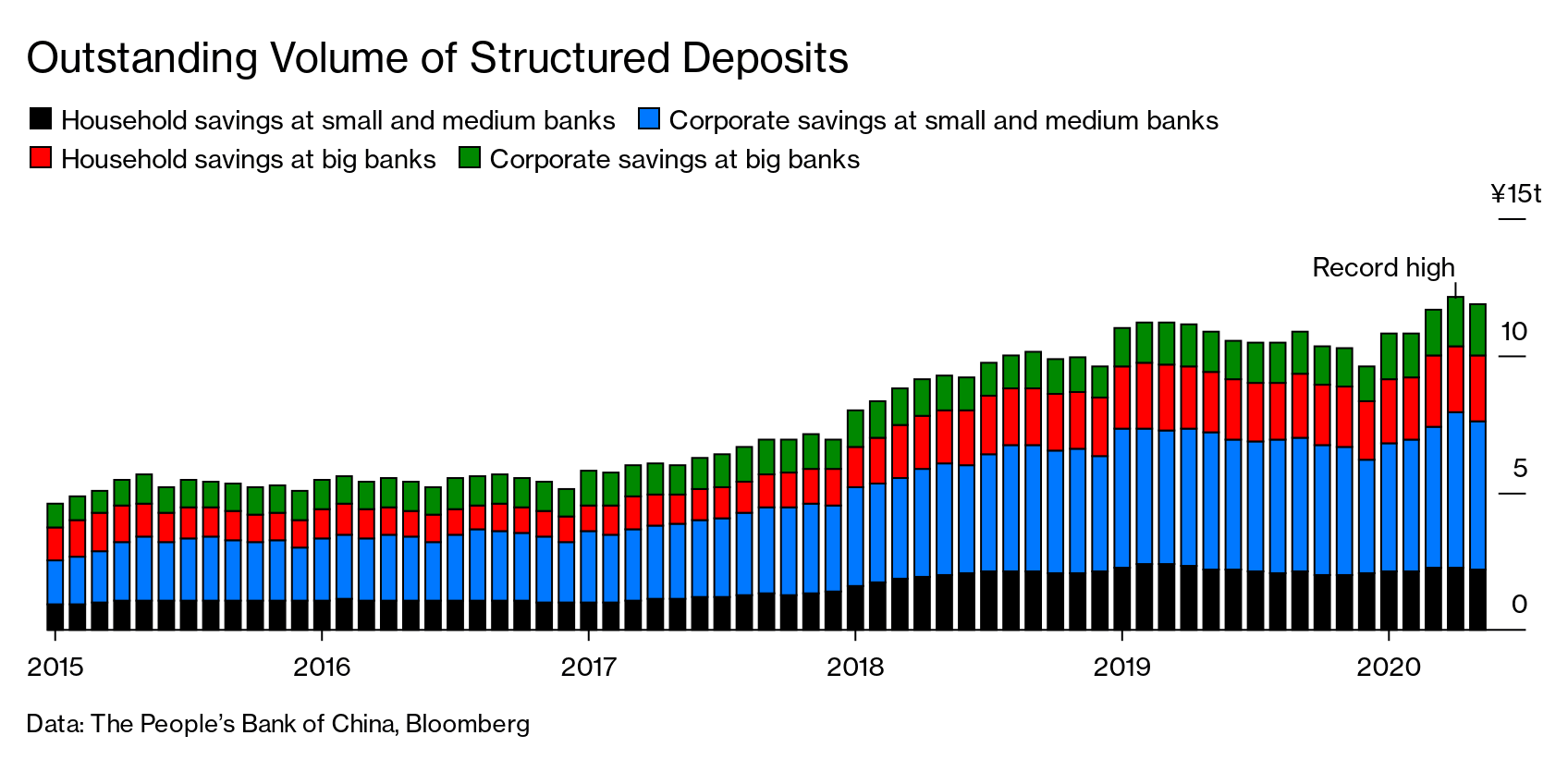

Structured Deposit 2020

According to MoneySENSE website, structured deposits can be equity linked, bond linked, interest rate linked or credit linked. There are no further details on the above bank promotion what investment product it is linked with. If you happen to be interested, you should clarify with the banking officer prior to taking up the structured deposit product.

Benefits

- Structured deposits have the potential to offer higher returns compared to traditional fixed deposits.

Risk

Structured Deposits Money Laundering

- Structured deposits are riskier products than fixed deposits. The returns may be lower than expected.

- Structured deposits are not protected by the Deposit Insurance Scheme. If the bank defaults, we may lose all of our deposit.