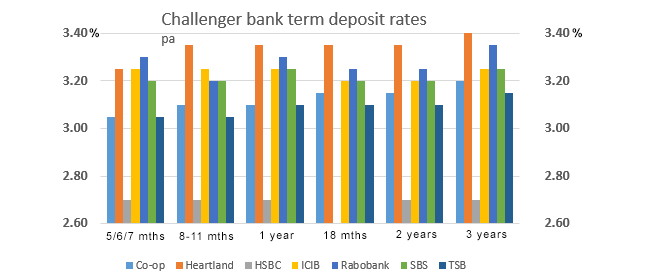

Rabobank Term Deposit

Markets have been in the grips of reflation, although the rise in market-based inflation expectations is not being echoed so far by households. Cost-push inflation is likely to be transient and it could even turn into disinflation. Thus, economists at Rabobank believe the European Central Bank (ECB) will ultimately look through this temporary volatility in inflation. After having been wrong on inflation for most part of the recent decade, the ECB cannot afford to make any policy mistakes.

Explore our personal savings account interest rates and find options to best suit your savings goals. Choose from our High Interest Savings, Purpose Saver, Notice Saver, PremiumSaver and Term Deposit Accounts. Rabobank's long-term deposit and senior debt ratings of Aa3, with a stable outlook, reflect (1) the bank's Baseline Credit Assessment (BCA) of a3, (2) two notches of uplift from our Advanced Loss Given Failure (LGF) analysis, and (3) one notch of uplift resulting from a moderate probability of government support.

Fixed Deposit

Key quotes

“Core inflation is projected to be stable in the coming months, but to tick higher again around the middle of 2021 due to base effects. However, as we enter 2022, underlying forces should also lead core inflation back below the 1% threshold. It is towards the end of 2022 that we may see a slow and very gradual recovery in underlying inflationary pressures. But it will not be before the end of 2023 that inflation has returned to levels which the ECB may see as broadly in line with its inflation target.”

Demand Deposit

“We believe that two key prerequisites for these inflationary pressures to become more sustained in the medium-term are still missing: a sustained rise in domestic wage pressures and continued budgetary stimulus.”

Rabobank Term Deposit Rates

“The rise in headline inflation over the course of this year may be taken by ECB hawks as a sign that inflation risks are on the rise, but for now we believe the ECB will ultimately look through this temporary volatility in inflation. After having been wrong (i.e. over-estimating) on inflation for most part of the recent decade, the ECB cannot afford to make any policy mistakes.”

“The cost-push nature and with much of this likely to be priced in already, this year’s inflation development – on its own- should not necessarily push long-term rate expectations higher.”

Get the 5 most predictable currency pairs