Flexi Fixed Deposit

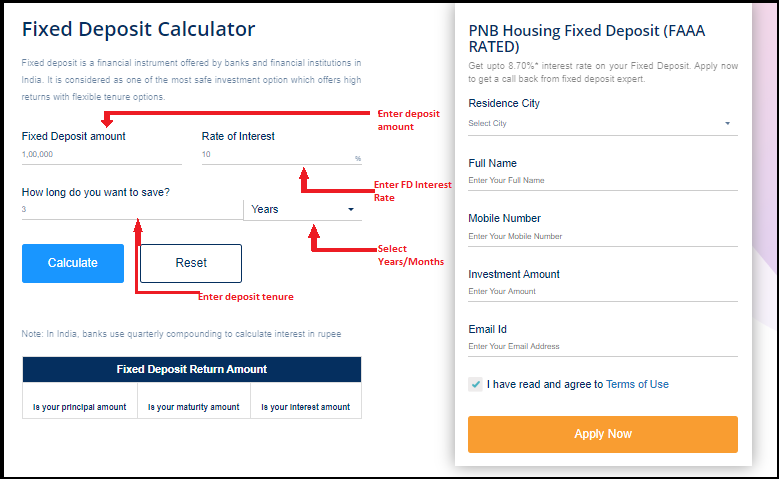

When you have a lump sum amount in your pocket and you are confused where to invest the first thing which comes to your mind is investing the amount in fixed deposit. The fixed deposit is one of the most preferred way of investing money. In fixed deposit you block your money for a longer period such as for five years, 10 years or 20 years depending upon the tenure you have opted to invest your money. As this is a long term investment and some people hesitate to invest money for so much longer period.

- Flexi Fixed Deposit Account

- Fnb Flexi Fixed Deposit

- Flexi Fixed Deposit Icici Interest Rate

- Flexi Fixed Deposit Icici

Flexi Fixed Deposit account A flexi deposit is one in which you have an inter-linked Savings and Fixed Deposit account. In this case also, during times of deficit in your Savings Account, the money is automatically transferred from your Fixed Deposit account. SBI Flexi Deposit Scheme: Depositors can decide to vary his/her installment amount, instead of a single fixed installment every month as in regular FDs. One can also choose the number of monthly. HLB Flexi Fixed Deposit rewards you with high interest and auto-sweep facility from Flexi Fixed Deposit to Flexi One Account or vice versa. Earn a high FD interest every month Watch your money consistently grow as you receive high FD interest every month at the prevailing 12-month FD rate. Get more from your FD interest.

There are people who want to have easy access to their money and they want to invest their money for a shorter duration due to other financial liabilities or other. For such investors the banks have come up with various options to invest their money for shorter duration the among these options flexi deposit is also very popular. Flexi deposit is one such investment instrument, which is equally popular among investors. It is very helpful in saving your money and achieving financial goals. But, some people got confused between these two investment tool. It is not very simple to make the decision as both have some advantages and disadvantages. So, it becomes more important to understand the differences of these two investment instruments and find out which one offers you more benefits.

- A Flexi-Fixed deposit is a special kind of deposit offered by banks in India and other countries. It is a combination of a demand deposit and a fixed deposit.The depositor is able to enjoy both the liquidity of savings and current accounts and the high returns of fixed deposits.

- Flexi Fixed deposit helps you to earn more return from your idling money, which you are looking forward for a future requirement. Freedom to place fixed deposits for number of days as per your requirement starting from 31days to maximum of 365 days. Enjoy fixed deposit rates. Monitor your deposit via Internet & Mobile Banking.

Let's find out some main differences between these two investment tools.

Different objective: Both the saving schemes have different objective. In fixed deposit you save money for longer duration for 3 years to 20 years and the term is pre-fixed. But in flexi deposit you choose a duration which is more convenient to you from one month to 15 months or more. In fixed deposit for longer tenure you deposit big amount, but in flexi deposit you deposit short amount on monthly basis, which converts into a big amount after maturity.

Short duration Vs. Long duration: The duration of the flexi fixed deposit and long term fixed deposit varies. The flexi fixed deposit you can avail from minimum 7 days to maximum 2 years. Besides, the long term fixed deposit is available for 5 years to 20 years. You can choose the tenure as per your ease. There is a huge difference in the duration of the flexi deposit and fixed deposit duration. Fixed deposit duration does not provide you flexibility where as flexi fixed deposit is popular becuase of its shorter and flexible duration.

Loan facility: There is no loan facility for flexi fixed deposit or short term fixed deposits. But, for fixed deposits of five years or more offers you facility to borrow the loan against the fixed deposit. You can borrow the loan of upto 90% of the amount of fixed deposit. This find of facility is not available for flexi deposits.

Tax benefits: Flexi fixed deposit does not offer you any kind of tax benefits, but long term fixed deposits such as five years fixed deposits or above five years offer you tax benefits under section 80C of income tax.

Difference in interest rates: The returns in longer duration fixed deposit is higher than the flexi fixed deposits. The interest you earn on your flexi fixed deposit is lower than longer duration fixed deposits.

Withdrawal facility: You can withdraw your amount from flexi fixed deposit any time whenever you are in need. The money will be credited into your account within 24 working hours. Besides, in five years fixed deposit you can't withdraw the money before the tenure and in case you do so, you can't claim the tax benefits anymore on your fixed amount.

(Updated on:26th October,2016)

Depositing your money into long-term fixed deposits is a common practice among working class to grow their money and save taxes. Long-term fixed deposit are really popular among people because of higher returns along with tax benefits. Apart from the conventional mode of saving money into long term fixed deposits these financial firms have also introduced short-term fixed deposits. These short-term flexi FD as the name suggests offer higher level of flexibility to the investors.

Flexi deposit offers more flexibility to customers for their convenience. It is a modified and advanced form of deposit, which is a good combination of recurring/saving account. Fixed deposit offers higher rate of interest along with liquidity by saving accounts.

Features and benefits of flexi fixed deposits

Higher interest rates on FD: These flexi FD interest rates are higher as compared to saving accounts, which enables individuals to gain more profits in their saved money.

Flexible tenure: Different banks have different tenure for flexi deposits. The minimum tenure to invest in flexi deposit is one day. An individual can opt for a tenure which suits him/her most.

Flexi Fixed Deposit Account

Invested amount: Individuals can select the amount they are comfortable to deposit with the bank. They can opt different amount in different banks according to their financial goals and benefits.

Premature withdrawals: Under these flexi fixed deposits banks allow premature withdrawal from flexi fixed deposit accounts. The terms and other charges may vary from bank-to-bank.

Loan options: Individuals can avail loans against flexi fixed deposits, according to the policies implemented by banks.

Simple and easy to open: It is really simple and fast to open a flexi fixed deposit account. Most of the banks follow the fast and transparent process of deposit account opening.

Fnb Flexi Fixed Deposit

Auto renewal: Generally, banks allow auto renewal of flexi FDs, ensuring account holders don’t have to worry about renewal.

Flexi Fixed Deposit Icici Interest Rate

Difference between flexi deposit & fixed deposit

Flexi Fixed Deposit Icici

- Flexi deposits offer flexibility to deposit amount, whereas normal deposit doesn’t offer you such flexibility.

- Flexi fixed deposit allows you to withdraw your amount before the maturity, whereas fixed deposit doesn’t allow you premature withdrawals.

- The tenure of the fixed deposits are longer than flexi deposit.

- Convenience to choose the tenure and amount in flexi deposit, whereas fixed deposits are entitled with pre-fixed tenures.