Chase Quick Deposit

Please turn on JavaScript in your browser

About Chase Chase is the consumer and commercial banking division of JPMorgan Chase & Co. It is one of America's largest banks and grew in size when it merged with the firm JPMorgan & Co. Today, the financial institution has $2.7 trillion in assets, and about half of all American households use its products. GOBankingRates has ranked Chase as one of the Best National Banks of. Make deposits and withdrawals at the ATM with your. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content. . Online POS Terminal users can view sales activity using the Chase Mobile Checkout app. Getting access is quick and easy. Call us to request access to Chase Mobile Checkout at 1-888-886-8869. Only the primary account owner can request the additional access.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Chase QuickDeposit℠

Deposit checks with the Chase Mobile® app.

- Overview

- Getting started

- FAQs

- Resources

Use Chase QuickDeposit℠ on the Chase Mobile® app to deposit your checks and access your funds quickly.

Save a trip to the branch and deposit checks on your schedule, virtually anytime and anywhere.

Deposit checks securely from your mobile phone or tablet. We protect your information and never store your passwords or check deposit data and images on your mobile device.

How to get started

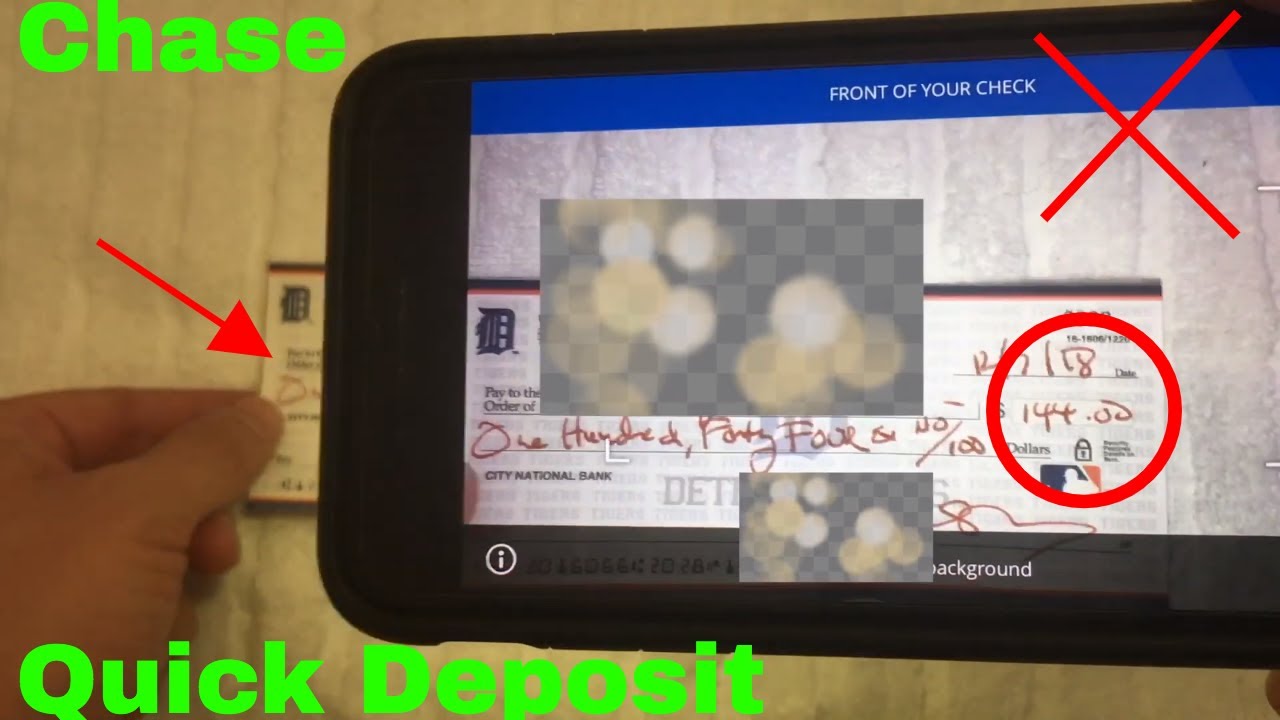

Watch how it works with this helpful how-to video.

Choose 'Deposit checks' in the navigation menu of your Chase Mobile® app and choose the account.

Enter the check amount and tap 'Front'. With our new 'Auto Capture' feature, the picture of the front and back of the endorsed check will be captured — or you can choose to take the pictures manually.

Confirm the details, submit and you're done.

Common questions answered

How does Chase QuickDeposit℠ work?

expandIn the Chase Mobile® app, choose “Deposit Checks” in the navigation menu and select the account. Enter the amount of the check and tap 'Front'. With our 'Auto Capture' feature, the picture of the front and back of the endorsed check will be captured — or you can choose to take the pictures manually. Verify your information and submit your deposit. After you submit, you can deposit another check or view the receipt. You’ll get an email when your deposit is received — and another when it’s accepted. If the deposit is rejected, you’ll also get an emailed explanation. Remember to properly endorse the back of the check with your signature and 'For electronic deposit only at Chase.'

When will my funds be available?

expand

Deposits submitted before 11 PM Eastern time on a business day generally will be available by the next business day. Deposits submitted after 11 PM or on a non-business day will be processed the next business day. However, we may delay availability if we require further review of the deposit. Any information about delayed availability will be provided in the Secure Message Center, which is accessible in the main navigation menu.

What should I do with my check(s) after I’ve deposited it?

expandAfter you complete your transaction, write “deposited” and the date of deposit on the face of the check. Please retain the marked check for two business days or until you receive our notification that your QuickDeposit has been accepted. After that time, you may destroy it.

Have more questions?

Chase Quick Deposit With Iphone

Chase Quick Deposit Online

24/7 access to deposit funds

- Chase QuickDeposit℠ — Securely deposit checks from almost anywhere.

- Chase ATMs — Conveniently deposit up to 30 checks and cash at most ATMs.

- Direct deposit — Automatically deposit paychecks.

Pay bills quickly & conveniently

- Online Bill Pay — Pay rent, mortgage, utilities, credit cards, auto and other bills.

- Chase QuickPay® with Zelle® — Send and receive money from almost anyone with just a mobile number or email address.

Helpful technology that saves you time and keeps you in the know

- Paperless statements — Digitally access up to 7 years of statements.

- Account alerts — Monitor finances, avoid overdrafts and more.

- Chase text banking — Check balances and transaction history with a text.